Recording owner payouts in the OwnerRez Property Management premium feature and then sending them through your Quickbooks integration can help automate your property management operations. Before you proceed with this article, we recommend that you review both the Property Management Overview and the Quickbooks Overview support articles for a thorough background.

Using the method described in this support article requires users to have an active QuickBooks account (QuickBooks Online, not QuickBooks Desktop) connected to OwnerRez, which you can connect using our QuickBooks setup and connecting process.

Owner payouts have been around for a long time, but they are often less understood and less utilized compared to statements and expenses, which tend to get more attention. Payouts are a record of the actual money transferred to the owner, while a statement indicates what the owner is entitled to receive. Although they sound similar, they are not the same.

For example, an owner might have a negative statement for a particular month. Instead of the owner sending a check to cover this negative amount, you may choose to carry it over to the next month. If the following month, the owner has a positive statement; the owner payout will reflect both the negative and positive statements combined.

Record Owner Payouts

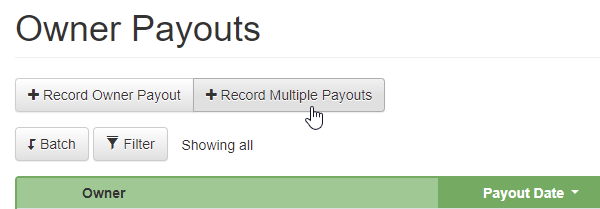

If you manage on behalf of 50 owners, manually entering 50 payments takes a long time. To solve this problem, we recommend that you use the "Record Multiple Payouts" for owner payouts feature.

Navigate to Property Management (PM) > Statements & Payouts > Owner Payouts > and click on the + Record Multiple Payouts button at the top.

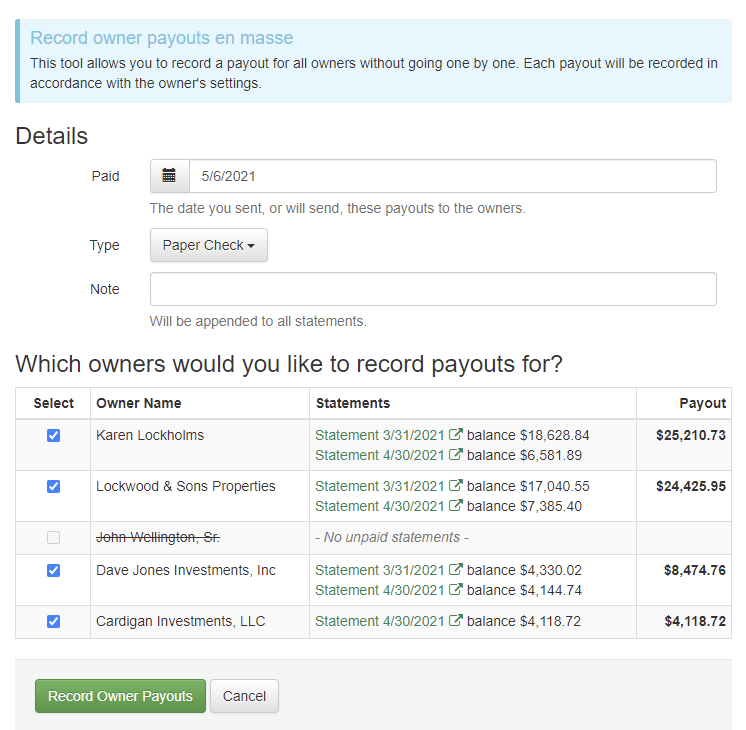

The Record Multiple Owner Payouts page will show you all the statements that need to be paid (ie. any that still have an "unpaid" or "partially paid" status) and what the owner will get.

The Record Multiple Owner Payouts page will show you all the statements that need to be paid (ie. any that still have an "unpaid" or "partially paid" status) and what the owner will get.

You can select the type of payment (bank transfer, check) for them and a note that will apply to all payouts. If the owner has multiple statements, the payout balance for that owner will be the delta of those statements' unpaid balances.

If you want to skip an owner, use the checkbox on the left to de-select that owner. Click the Record Owner Payout button at the bottom, and the payouts will be saved. To be clear, when recording individual payouts, OwnerRez does not actually send a check or ACH money to the owner's bank account. We assume that you will do that at the same time. And if that part (sending the actual money) has frustrated you, keep reading!

Send Owner Payouts to QuickBooks

You can push owner payouts directly into QuickBooks as bills or checks. This means that you can use the tools in QuickBooks, like the Checks To Print queue or Pay Bills Online feature, to send money to all your owners quickly after recording multiple payouts.

This tool can also be found in the PM > Owner Payouts area above the Payouts grid. You'll see a "Send to QuickBooks" button that will either be enabled or disabled depending on whether you have a QuickBooks account connected to OwnerRez. To be clear, this only works with QuickBooks Online, not QuickBooks Desktop, and it has to be an active connected QuickBooks Online account which you can connect using our QuickBooks setup and connecting process.

The first time you click the button, OwnerRez will show you a configuration page where you'll need to map some options.

The "As Of Date" field allows you to set the starting date for when payouts should be pushed across to QuickBooks. After all, you probably don't want to push old payouts if the money for those payouts has already been sent. You can also specify whether you want to create Checks or Bill records in QuickBooks. If you want to print checks, use the "Check" type. At the bottom, you'll need to map the owner in OwnerRez to the vendor or customer in QuickBooks. This will allow OwnerRez to know what vendor or customer name to use when creating the check or bill in QuickBooks. When you're done configuring everything, click Save, and you'll be ready to go.

After configuration is over, you'll see the actual page to send payouts to QuickBooks, and it will look and act like all of our other batch pages.

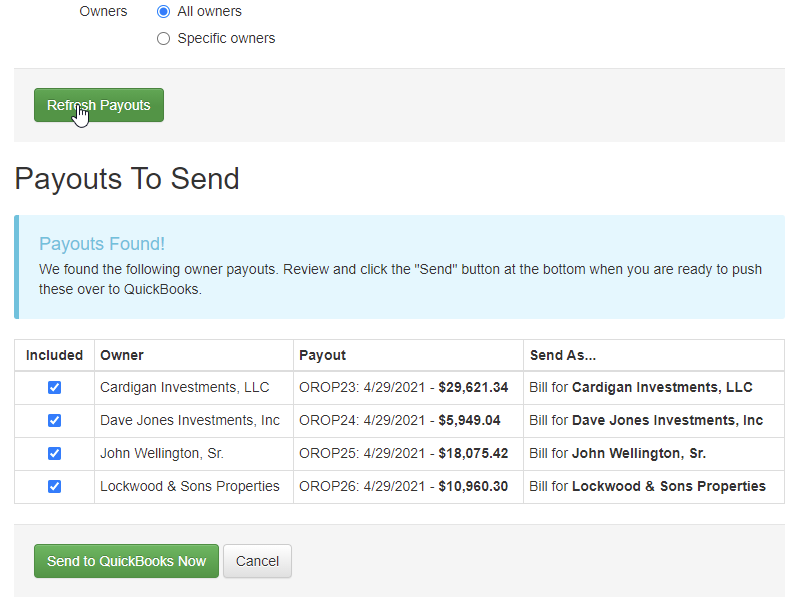

The page works in two stages. First, you'll use the top options to find and show payouts that need to be sent to QuickBooks. Then, after seeing the payouts, you can select or confirm the ones to send, and OwnerRez will immediately push those payouts into your QuickBooks Online account as checks or bills. Let's step through the process...

Go ahead and click the Show Payouts button. By default, it will show any payouts that were never sent to QuickBooks in the past for all owners and for all dates back to the starting "As Of Date" you selected in the configuration area. The payouts will show right below that on the same page.

By default, all payouts will be selected, but you can de-select any that you don't want to send across to QuickBooks. If you need to change the criteria, simply do that at the top and click the "Refresh Payouts" button. The payouts will reload at the bottom, and you can re-confirm the selection.

When you have the group of payouts showing and selected that you want to send across, click the bottom "Send to QuickBooks Now" button, and OwnerRez will create check or bill transactions in QuickBooks while you wait.

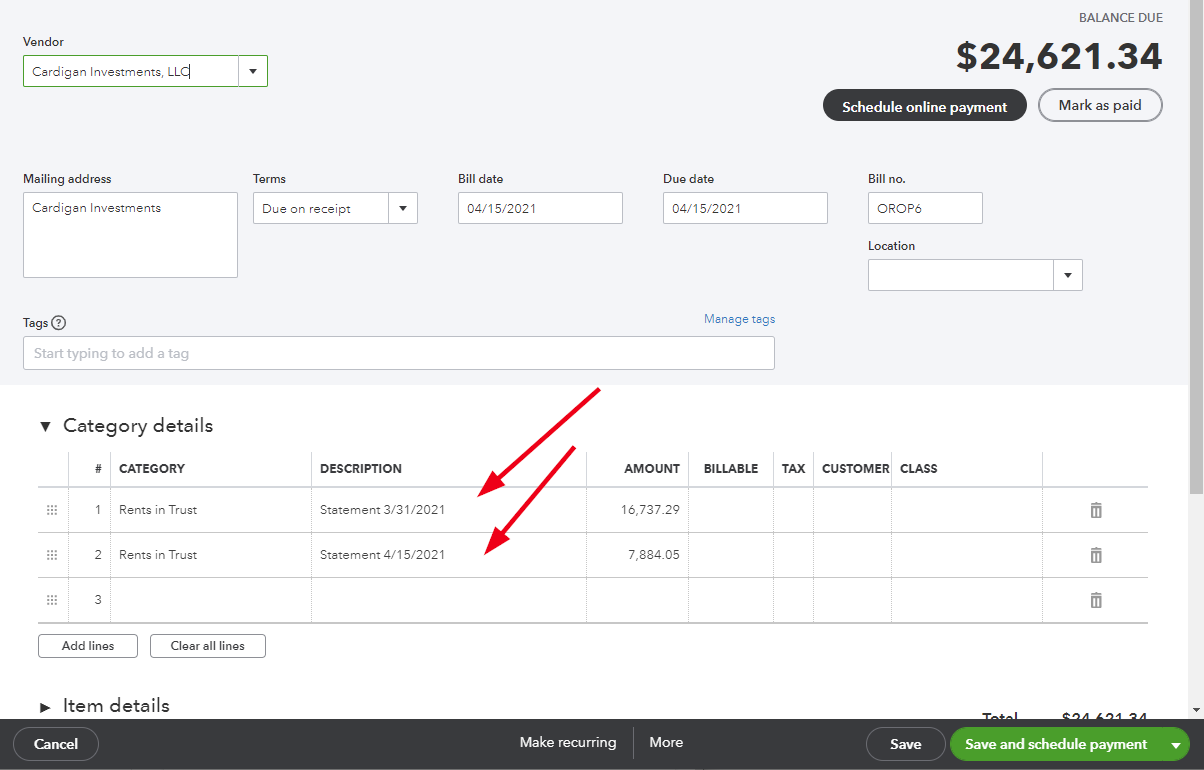

You can double-check your work by jumping into QuickBooks and clicking on the Expenses menu. You'll see the check or bills that OwnerRez just sent over.

Drill into one of those check or bill transactions, and QuickBooks will show the details inside. Notice that if the payout is for multiple statements, both statements are referenced with the correct amounts.

After your payouts are in QuickBooks, you can use the Checks To Print or Pay Bills Online queues in QuickBooks to send money to the owners quickly, greatly eliminating the time to enter and send owner payouts.

This past week, we also added some "In Period" columns for owner statements. Most PMs only show the owner the money they earned and not the booking totals, and if the booking overlaps the period, many PMs only like to show the money earned inside that period. You can do this for many revenue fields.

The new "In Period" columns are only available in custom statement views; they do not appear in any of the default system views. Go to PM > Statement Views and create a statement, and you'll see the new columns displayed in the drop-down list.

These columns show the exact same thing as the regular ones, only the amount is pro-rated for the time the booking is in the statement period. To be clear, it's possible for these columns to return $0 if the booking is not inside the statement period. For instance, suppose a booking occurs in April and is remitted 100% in April. Later in May, after the booking had departed, you discovered that the guest owed more money and the charges and payments were changed on the booking. The booking would have a new remittance balance and be picked up in the May statement. However, because the booking originally occurred in April, the "In Period" columns would all show $0 even if the "Remitting Now" column had an amount to remit to the owner.

While we were adding columns, we also added two new statement columns for Zero Commission Charges and Non-Standard Commission Charges. These columns will help you show your owners the total guest charges that had zero commission or non-standard commission on them. This is common for things like cleaning fees where the total was passed through to the owner or expensed to the PM. If you have this situation, you can select the Zero Commission Charges column, name the header "Cleaning Fees" and then the owner will see how the gross minus cleaning fees leads to a net that your commission is applied to.

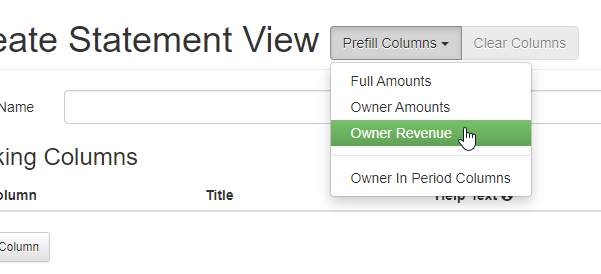

While you're messing with the custom statement views, notice that there's a new "Prefill Columns" button at the top.

When you click the Prefill Columns button, you'll see the three system views and any custom views you've already created. If you select one of those views, the page will fill in with all those columns so that you can hit the ground running. From there, make your changes and then save.

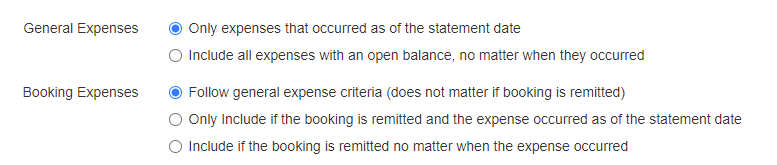

The Included Expenses option has two sections of criteria—one for general expenses (i.e., non-booking expenses) and one for booking expenses. This allows you to fine-tune your selection and pick up booking expenses exactly when you want, no matter when the expense date occurred.