Sure thing, some answers:

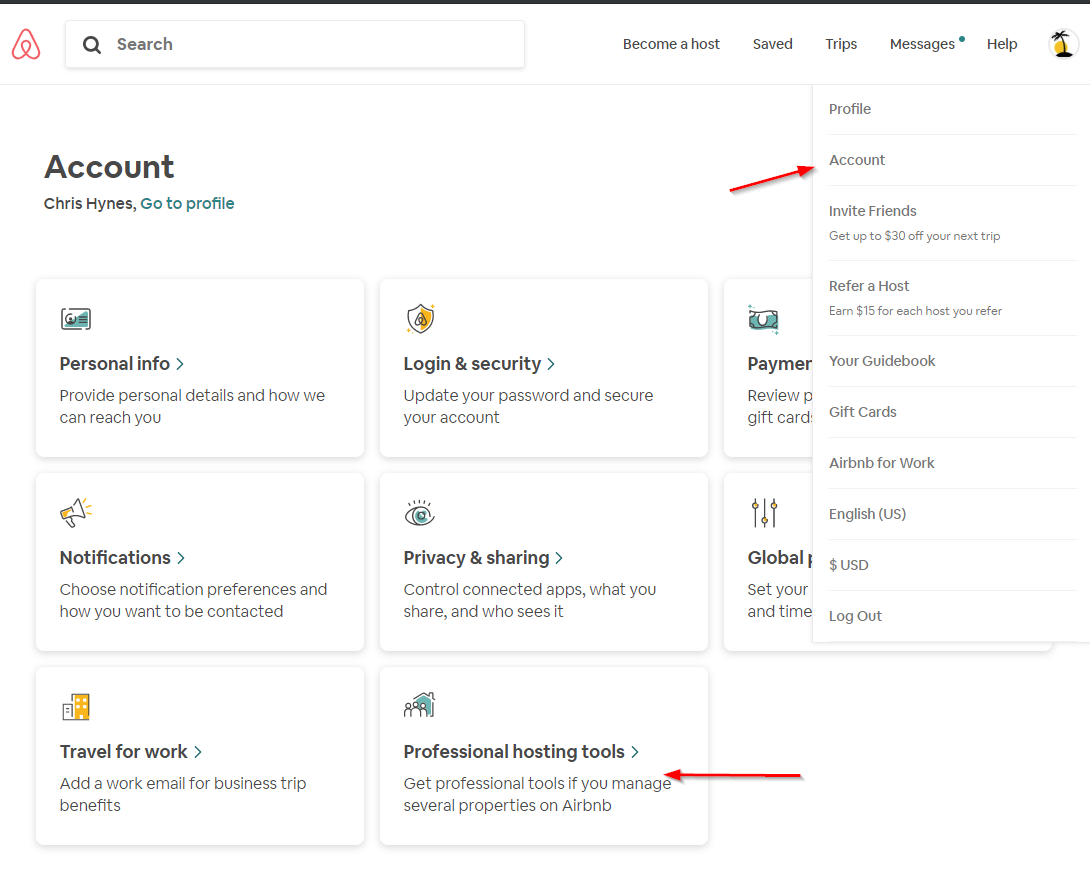

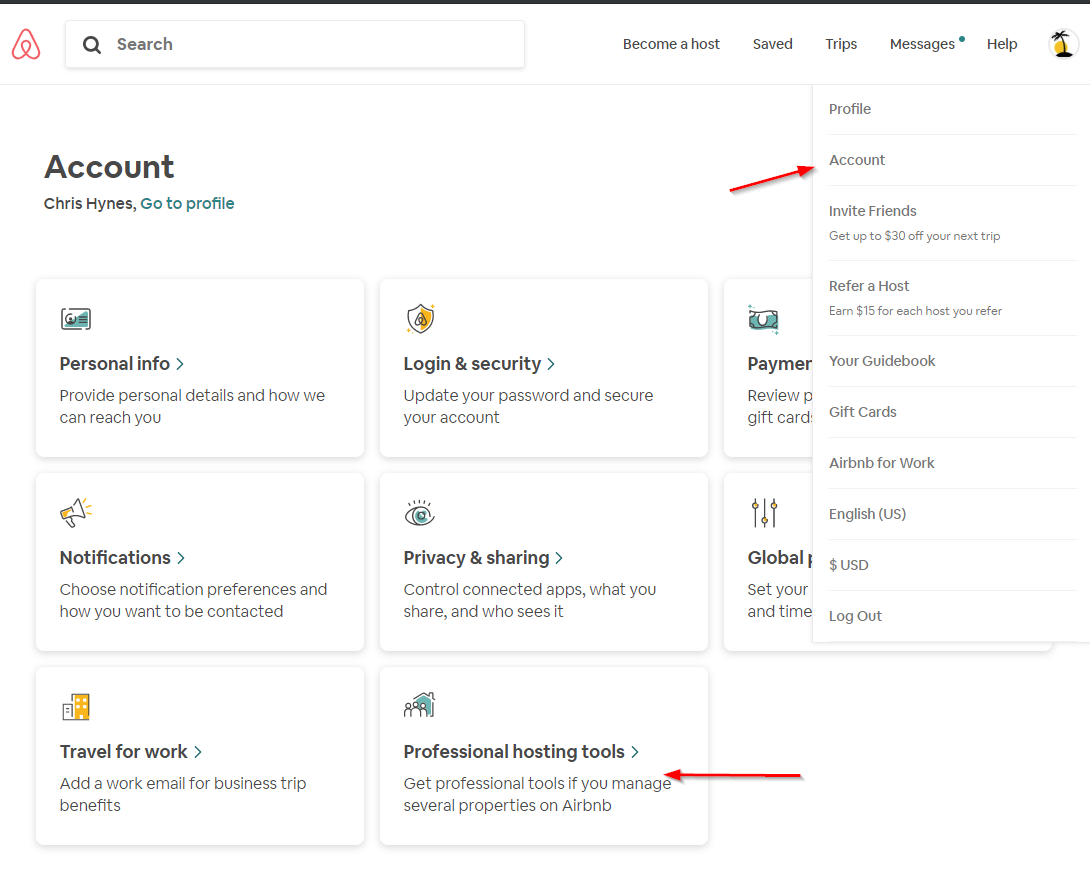

1, 2) You should be able to enable professional hosting tools yourself in the account menu -- see screenshot. I don't think it requires a business verification --I just tried this with an account that's not set for a company and it was able to enable the pro tools.

3) If you go to the Local taxes and laws section in Airbnb for your listing, do you see the Custom option? Look at the screenshot here: https://www.ownerrez.com/support/articles/channel-management-api-integrations-airbnb-common-issues-questions#taxes

If you do have Custom available to you, you can configure taxes that way.

If not, you can have OwnerRez factor taxes into rates. To do this, go to the channel bridge or Airbnb API settings and set tax calculation to "included in Airbnb amount". This will cause OwnerRez to add any tax applicable to the Airbnb listing site to rates during pushed and back it out when bookings are imported. So go over to the Tax area and set the listing site criteria on the ones that Airbnb already remits to "Everything but Airbnb". And the ones you want to add rates, set those to All so that they do apply to Airbnb.

You could also do this yourself manually by setting the rate adjuster like you mentioned, but if you do that we won't know to back out the taxes again on the booking import.