Security deposits (for damage which are done as "holds" on the credit card) are a great feature in our system, and we have a lot of great automation built around that process.

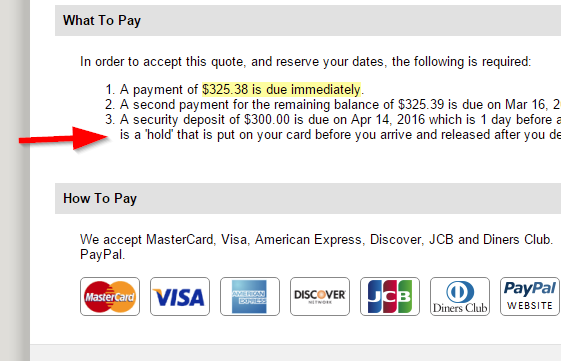

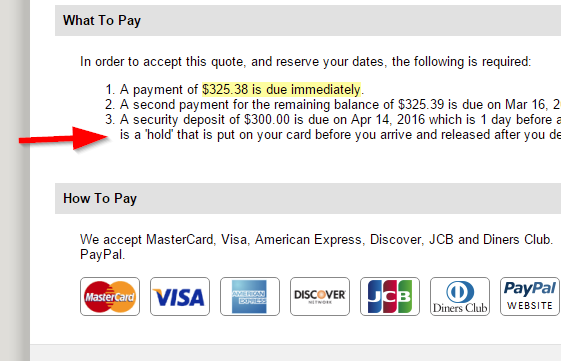

The charges that you see on the quote are not part of the security deposit. The security deposit (or "security hold" which is a better of thinking about it) is part of the process that the guest agrees to when viewing and accepting the quote. For instance, here is a sample quote that the guest sees. I've arrow'd the part about the security deposit. (click to open bigger view)

All of this is dynamic based on your settings and options in your account.

All of this is dynamic based on your settings and options in your account.

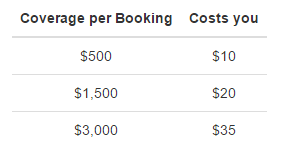

You create rules (property > rules) about how you want the security deposits to be held. For instance, when it's taken, for how much, etc. our system the automatically places a hold on the guest's credit card (or authorized PayPal transaction) for that amount. After the booking is over, we send you an email each day until the security deposit is released. It's very simple to release - one click. If you want to collect on it, that is simple to do as well.

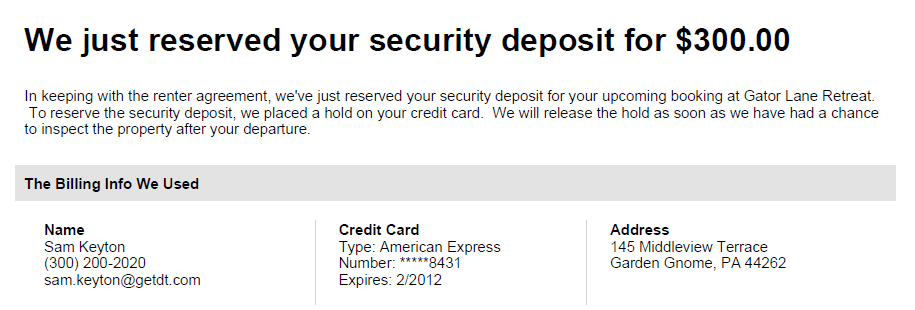

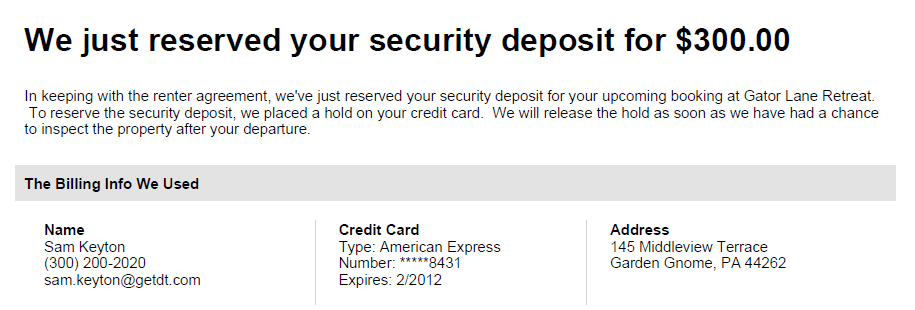

There are a variety of emails that are sent to the guest as well during this process. For instance, here's a plain vanilla "receipt" style email that is sent to the guest when the security deposit is reserved by the system. (click to open bigger view)

If the credit card failed, there is a email template for that as well as when it's released and other things.

If the credit card failed, there is a email template for that as well as when it's released and other things.