VRBO does not allow owners to specify any other tax than the amount that VRBO themselves are collecting & remitting. So I have to send the guest a payment request to pay the additional 2% local lodging tax that the site did not collect.

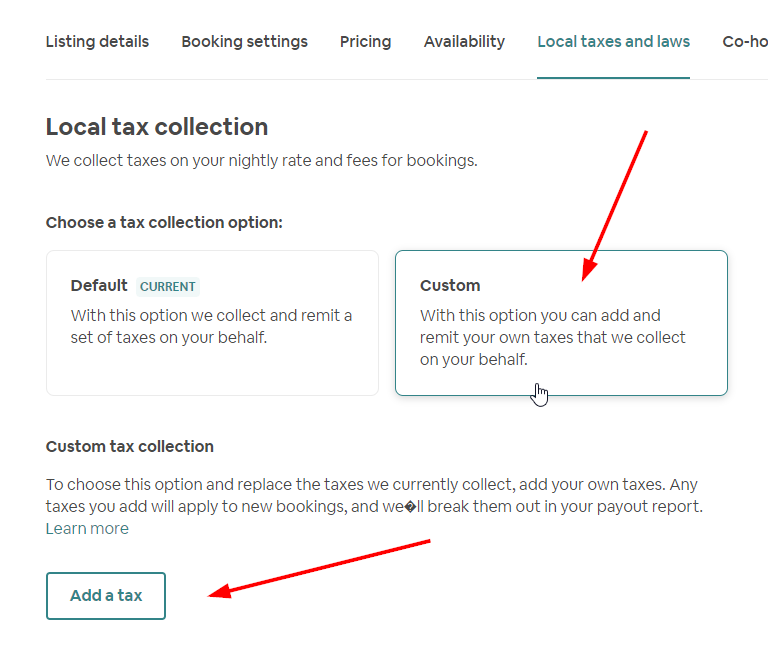

On Airbnb, one of the properties that Airbnb does not collect the entire tax for (located in VA) DOES have the "Custom > Add a tax" option, but the other property that Airbnb does not collect the entire tax for (located in CO) does not have that option.

I think you are saying that at least for the property that does have the "Add a tax" option on Airbnb, if I choose that option then Airbnb will collect the entire amount required and remit all of it to me, and then I would be responsible for remitting the tax to the appropriate authorities.

Let me ask you this: I am in the process of having all of my VRBO listings (and soon Airbnb now that it is possible) to be handled through your Channel manager. Do I understand correctly that once that happens then going forward any VRBO or Airbnb bookings will have 100% of the tax paid through to me and then I'll pay the tax to the authorities?

Thank you for your help. Since I am new to OR I am reviewing each booking that has been imported from those sites and need to make sure I am getting the $$ correctly allocated for each booking.